As the new year unfolds, many recent university and high school graduates are just landing their first full-time or contract-based jobs, stepping fully into the world of work and embracing a milestone that signals independence and the start of financial freedom.

However, responsibilities such as rent, utilities, student loans and everyday expenses can quickly turn that excitement into stress if money isn’t managed carefully.

Delories Jones, head of JN Premier and the JN Bank Youth Banking Unit.

Against that background, Delories Jones, head of JN Premier and the JN Bank Youth Banking Unit, emphasises the importance of establishing smart financial habits from the outset.

“It’s not about how much you earn at the start,” she says. “It’s about putting the right structures in place early so you can build confidence and long-term financial stability. What matters most is setting up systems that will ensure your money works for you and that starts with the first pay cheque.”

She provides the following tips to guide people entering the workforce to manage their income effectively:

Start with a realistic view of your money

Even before that first salary arrives, first focus on understanding your fixed costs, which may include utilities, loan repayments, transportation and other essential expenses. Start with simple weekly spending limits for flexible costs, such as groceries. Weekly limits are easier to adjust in real time, especially when the first income is modest.

Even before that first salary arrives, first focus on understanding your fixed costs, which may include utilities, loan repayments, transportation and other essential expenses. Start with simple weekly spending limits for flexible costs, such as groceries. Weekly limits are easier to adjust in real time, especially when the first income is modest.

Begin to save from the very first pay cheque. As a flexible starting point, try the 50/30/20 rule, which allocates portions of income to needs, wants and savings respectively.

Separate accounts for better money management

One of the most effective and often overlooked steps people can take is separating everyday spending from savings, regardless of income level.

Consideration should be given for a current or everyday transactional account to handle daily essentials such as rent, bills and transport, and a separate savings account, even for holding a small balance. Savings doesn’t have to mean building wealth straight away. When everything sits in one account, it’s hard to keep track of what you want to save and you may end up overspending. Many people discover far too late that they have not put aside enough funds to provide a cushion, in the event of an emergency or for their retirement.

Separating everyday spending from savings can also ensure greater protection and safety of funds. Link your debit card to your everyday transactional account and only load into that account what you plan to spend, so even if the card is lost or compromised, your savings remain untouched.

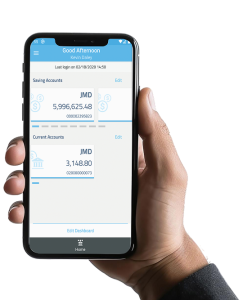

At JN Bank, for example, individuals can easily open both accounts using the ONE JN Passport.

Automate payments to stay on track

Automating payments is a simple way to stay on top of financial obligations. Setting up scheduled transfers for rent, utilities, subscriptions and other recurring expenses can ensure bills are paid on time and reduces the risk of late fees. Automation can help you manage your cash flow more effectively even on a tight budget.

Smart Banking

Beyond accounts and balances, be smart with banking. Take advantage of institutions with convenient banking and budgeting tools, such as JN Bank LIVE and the JN Bank Savings hub, which can help make managing money easier.

Being able to check balances, move money and pay bills online at your own convenience gives you control. That visibility also helps you make better decisions.

“It’s about awareness, early action and choosing systems and support that make money management feel possible from day one. You don’t have to do it alone,” Mrs Jones advised.