Get a loan of up to 95% of the amount in your savings account.

Monitor your home or business easily from your smart phone or other mobile device from anywhere with Guardsman’s iProtect application. We have the loan to help you get it. No collateral required.

Features

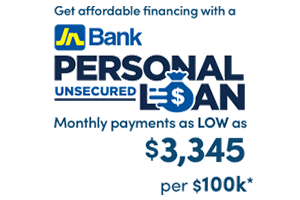

- 100% financing*

- Up to 3 years to repay

- Rates as low as 12.50%

- Interest calculated on reducing balance

Benefits

- Low processing fees

- Optional savings

- Low monthly payments

Requirements

- You must be a Jamaican 18 years or older

- Valid identification: driver’s licence, passport, voter registration card

- Proof of address: utility bill, credit card statement or bank statement

- Tax Registration Number

- Proof of income: income verification letter (job letter), or completed JN Bank income verification form and last three months’ pay slips

- Completed statement of affairs – income and expenditure statement

- Signed loan agreement

- Signed Salary Deduction Letter/Standing Order form

- Signed consent to pull credit reports from credit bureaus

- Signed Promissory Note

- Bank statements for primary account displaying last 12 months activity, current Financial Statements if available, and Auditor’s Confirmation (Self-employed persons only)

- Completed Know Your Customer form (if your JN member records need updating)

Terms and Conditions

- Loan repayments are to be by way of salary deductions or standing orders from an account to which the borrower’s income is deposited. Loan repayment is calculated on the reducing balance.

- TDSR should not exceed 50%.

- Credit Reports – Mandatory credit report check for all applicants. Credit Bureau Fee is to be fully borne by the applicant. As the loan is partially unsecured, the borrower’s credit history should be good to excellent.

* Notice of any rate change(s) will be provided in writing, by physical or electronic means, to our customers, 45 calendar days in advance of any such change(s) being implemented