The Tourism Enhancement Fund (TEF) Loan Programme managed by one of the country’s leading small business credit facilities, JN Small Business Loans Limited (JNSBL), has helped to strengthen the capacity of more than 143 businesses in, or linked to the tourism sector.

Introduced initially for the repair and upgrading of hotels damaged by Hurricane Dean in 2007, the Loan Programme was expanded to include a wider range of enterprises which add value to the tourism product.

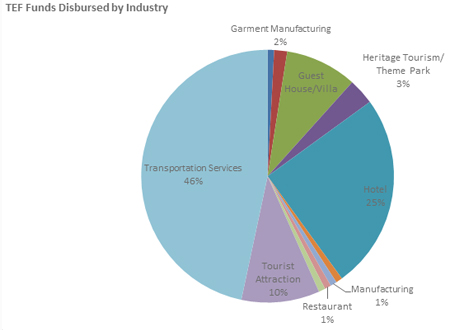

To date, in excess of $352 million have been distributed to hotels, transport and tour operators, agro-industries, manufacturers, attractions, restaurants and the craft industry, assisting them to increase their competitiveness and foster partnerships that generate greater economic gains from the lucrative tourism trade.

Companies have benefited from a suite of loan products under the TEF loan programme, which include the current TEF expansion facility, through which hotels and attractions may access up to $3 million to refurbish their properties, at an interest rate of five percent on the reducing balance.

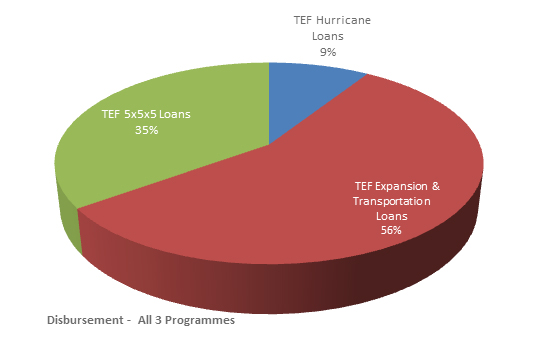

The chart below shows percentage disbursements of all three programmes to-date.

Hotel Mockingbird Hill in Port Antonio, Portland is among properties that have benefited from the TEF expansion loan. Proprietor, Shireen Aga, learned about the facility through the Jamaica Hotel and Tourist Association and used the funds to upgrade the property.

“The application process was straight forward and easy; and I was able benefit from the programme more than once,” she said. Ms. Aga invested the loan funds in a renewable energy system and also expanded the property’s rain water harvesting facility, which have both helped to reduce her utility bills significantly. “The traditional bank loans were not an option, we could not afford those loans” she lamented. “The TEF loan from JN Small Business is the best combination for small business owners like myself,” she said.

In addition to the expansion loan, contract carriage and tour operators who are members of umbrella groups, such as the Jamaica Union of Travellers’ Association (JUTA) and the MAXI Tours, may also access financing of up to $2 million under the TEF loan scheme, to purchase motor vehicles or refinance existing motor vehicle loans. The funds are available to operators at an interest rate of five percent per annum on the reducing balance.

Ralston Anderson, a JCAL registered tour operator who operates from the RIU Hotel in Negril has benefited from the loan programme.

“I had to change my bus, it was giving a lot of problems and I saw no way out. I heard about the loan through a JCAL meeting and immediately checked it out. It was the best thing around town, no other bank could match the interest rate” Mr. Anderson said. He said he is happy with the loan and remarked that the “payments are very comfortable and I would not have a new vehicle today if it wasn’t for JNSBL and the TEF”

“JN Small Business is my lifeline” added Michael Foster, a MAXI Tour driver who operates from the cruise ship pier in Falmouth. “The application process was so simple and easy; there was no red tape.” The project officer Mr. McCarty was very professional and told me exactly what I needed to do.”

Mr. Foster said that JNSBL and the TEF facilitated him in many ways, including, helping him to get back on track. “They gave me a start again and I am speaking from the bottom of my heart” he said with enthusiasm. “I am so happy with my loan right now I have recommended the programme to others and I even helped them to complete their application form.”

Consolidating its partnership with JNSBL in 2011, the TEF has expanded the loan programme to also benefit small operators who conduct up to 30 percent of their trade in the tourism sector. Under this loan product, these companies may access up to $5 million, at an interest rate of five percent per annum on the reducing balance for five years, which is known as TEF 5x5x5. The facility is specially designed for companies, sole traders and partnerships; however, new businesses which demonstrate experience in the type of business being pursued and possess a clear business plan outlining markets for their goods or service may also qualify for the loan.

The TEF Loan Programme offers entrepreneurs the opportunity to improve performance in a manner that is not only beneficial to their operations, but to the economy as it creates sustainable channels to allow profits from the tourism sector to flow directly into the financial system and enrich the lives of Jamaicans.

To apply for funding under the TEF Loan Programme, business owners may visit any of the 29 JNSBL locations across the island, or visit the JNSBL website at www.jnsbl.com. They may also call 1-888-725-6267 to speak with the project officer, Brenton McCarthy.

JNSBL: “We mean BIG things for SMALL Businesses”