Understanding your credit card statement is key to using your card wisely. It’s more than just a bill; it’s a record of your spending habits, offering an opportunity to assess and adjust your financial behaviour.

Let’s break down your statement to help you make better financial decisions with your credit card.

Payment Information

![]()

- Statement Balance

The is the total amount owed at the end of the billing cycle, which is usually about 30 days. Paying this off in full each month allows you to take advantage of credit without incurring any interest.

- Minimum Payment

This is the minimum amount to be paid to avoid late fees and delinquency. However, this is only a short-term fix and paying this alone can lead to long-term debt if not managed carefully.

- Payment Due Date

This is the final date of payment to prevent penalty fees.

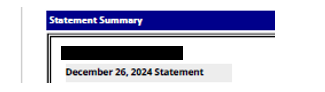

Statement Issue Date

The statement issue date ends one cycle and starts another one. Knowing this can help with cash flow.

Any new purchases made on the day the statement is issued, which is settled before midnight, can still appear on that statement. If you make a purchase right after your statement is issued, it won’t show up on your bill until the next cycle. That means you could get a full extra month or more before that charge is due and you need to pay it off, which can really help with managing your money.

If you make a payment on the statement issue date, it will count towards reducing the balance, but doesn’t change what’s owed on the current statement, because that statement has already been finalised.

If you don’t pay the full balance from the previous statement by the due date, you’ll be charged interest. Even if you made a payment on the statement date, interest could still be applied and it could also affect new purchases made that day or after, because you lose the grace period until your full balance is paid off.

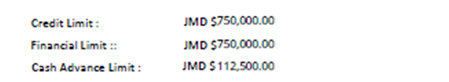

Credit Limit, Financial Limit, Cash Advance Limit

Both the credit limit and the financial limit refer to the overall spending cap a person can charge to their credit card without incurring penalties, provided the funds are still available.

The cash advance limit is the portion available for cash withdrawals from ATMs or bank counters. However, this limit typically comes with different, and often time, less favourable terms. If you do use this, be sure to pay it back as quickly as possible.

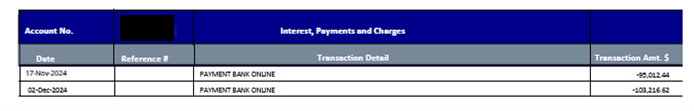

Interest, Payments and Charges

Here you can view all payments made since the last cycle, as well as any fees or penalties applied to your account. Understanding these details will help you stay informed about how your debt is being managed and what it is costing you.

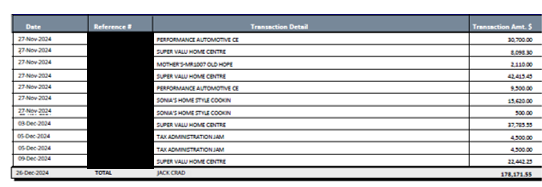

Transaction details

Here you can view the list of every purchase made during the billing cycle. In addition to being a record of activity, this section can help you spot unauthorised charges, track spending patterns, and reassess financial habits.

Remember:

Having a credit card is great and understanding how to use it makes all the difference between building strong credit and falling into debt. However, it’s not just about swiping responsibly. Reading and understanding your credit card statement is just as important. It helps you track your spending, catch errors, avoid interest charges, and stay on top of due dates. The more you understand your statement, the more control you have over your finances.

In response to research highlighting low levels of financial literacy in Jamaica, the Caribbean Development Bank (CDB), through its Basic Needs Trust Fund (BNTF), has partnered with the JN Foundation and Canada’s Local Engagement and Action Fund (LEAF) to deliver financial literacy training to 200 community-based and civil society organisations.