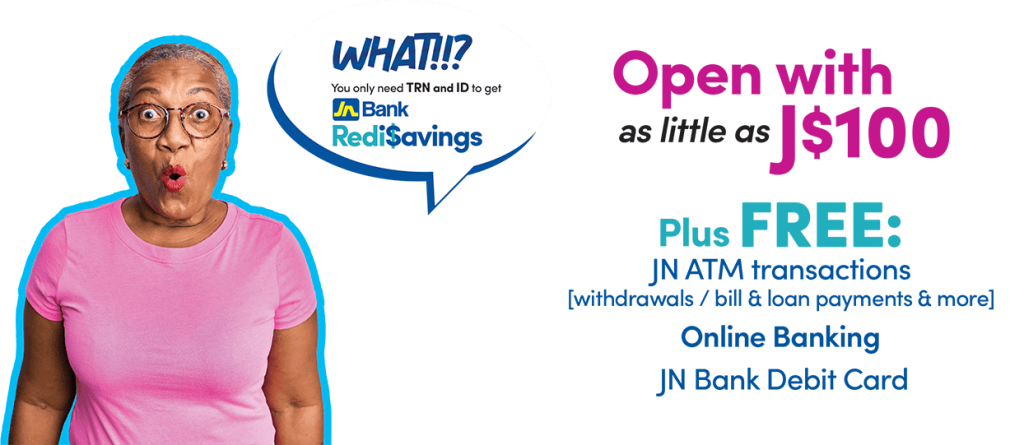

With the JN Bank Redi Savings the process of opening a saving account has been simplified to allow you ease of access to start saving for your goals.

‘Redi’ to save?

JN Bank Redi Savings makes it quick and simple!

All you need is your Tax Registration Number (TRN) card or letter and ID to access any of the listed Jamaican dollar accounts.

TRN

A national ID such as driver’s licence OR

(TRN not required if driver’s licence is used)

Electoral Registration or Passport

You have the option to open a regular savings account, a JN Bank Partna Plan, or save for a fixed period in a JN Bank Direct Gain account.

Regular Savings Products

Features

- Take only your TRN and valid ID

- Open with a minimum of JA$100

- Deposit up to $200,000 in your account monthly

- No minimum balance fee

- No monthly service charge

- Get a JN Debit card with FREE transactions at JN ATMs

Contractual Savings Products

Features

- Start with as little as $500

- Save for a fixed period of 16, 24, 32 or 48 weeks

- Make deposits weekly, bi-weekly, and monthly

- Make deposits by salary deductions or standing orders

- Interest is calculated and paid on the chosen plan and is directly related to the amount saved in each designated plan

- Rates vary according to amounts on the period of deposit

- Interest calculated daily and paid at maturity

Fixed Deposits Products

Features

- No monthly service charge

- Deposit minimum of $25,000

- Deposit limited to no more than $200,000 monthly

- Save for a period of 30, 90, 180 or 365 days

- Attractive interest rates

- Interest calculated daily and paid at maturity

Frequently Asked Questions

What is JN Bank Redi Savings?

The JN Bank Redi Savings allows you to open a savings account with fewer Know Your Customer (KYC) requirements. All you need is your Tax Registration Number (TRN) and a national ID, such as your driver’s licence (TRN not necessary with driver’s licence), Electoral Registration Card or passport.

What benefits do I get saving with JN Redi Savings?

There are many benefits to saving with JN Bank Redi Savings! Here are a few:

- You only need to take your TRN and ID to start saving

- You can start with a minimum balance as little as $100

- There are no minimum balance fees

- There are no monthly service charges on your account

- You can withdraw only what you need and save the rest securely

- You get an ATM card that you can swipe at stores to make purchases. This means you no longer always need to walk with ‘hard cash,’ which is safer

- Convenient access to funds through JN Bank and Multilink ATMs and using online banking through the JN Bank LIVE platform

- You can show your JN Bank ATM card at several stores in our JN Rewards programme to access discounts and save between 5% and 20% when you show or swipe your card

- Your savings account will help you to develop a ‘financial footprint’, which means that it provides a history of your financial pattern that will be helpful when you need a loan

What documents do I need to benefit with JN Bank Redi Savings?

All you need to take along is your tax registration number, also known as your TRN, and a national ID, such as your driver’s licence (TRN not necessary with driver’s licence, as your TRN is already on your licence), Elector Registration Card or Passport. In addition, there will only be a few other documents that you will need to sign.

Who can benefit from JN Bank Redi Savings?

Anyone can open any of the eligible accounts available with JN Bank Redi Savings! All you need is your TRN and ID*.

What are the eligible accounts available with the JN Bank Redi Savings?

Your JN Bank Redi Savings offers a variety of account types that you can open using only your TRN and ID. You can open either:

- A regular savings accounts with a minimum deposit of $100

- A JN Partna Plan with $500

- JN Bank Direct Gain fixed savings account with $25,000

Can I save in foreign currency in my Redi Savings Account?

Unfortunately, you cannot save in foreign currency with Redi Savings. Any foreign currency amount you want to deposit to your account must first be converted to Jamaican dollars. If you want to save in foreign currency, you will need to provide additional customer information to open a foreign currency account.

Conditions Apply*

Can I access Redi Savings if I am unemployed?

Yes, you can but unemployed adults who are NOT a beneficiary of a government assistance programme must provide evidence of the source of funds to be saved in the account and complete and additional form.

Unemployed adults who are on government assistance programmes, such as the PATH programme, Poor Relief or a pension beneficiary can access JN Bank Redi Savings using only their TRN and a valid government-issued ID.

Is there a limit on how much I can save with Redi Savings?

Yes, there is. You can deposit up to $200,000 monthly to your account.

Is there anything else that I am unable to do with my account?

Yes, in addition to the limit of $200,000 that can be deposited monthly to your account, you will be unable to accept wire transfers from banks overseas to your account. However, you can send money from your account to another bank account locally or overseas.

Do I get an ATM card so I can withdraw from my account at the machine, and to swipe when I spend in stores?

Of course you do! And with your JN Bank ATM card you can also access discounts at several stores in our JN Rewards programme, by simply showing or swiping your card to make purchases. You could receive a discount of between five and 20 per cent on your purchase.

If I cash my Poor Relief/ PATH cheques at JN Bank, can I simply open an account with JN Bank Redi Savings and deposit my funds to it?

Certainly, you can! This means you will have the opportunity to better manage your money and bank conveniently. It means that you will also have a financial history that will be helpful when you need a loan.

Can I add someone to my account?

Yes, you can add someone else to your account. The joint account holder(s) will also need to present their TRN and valid ID in order to open the account.

Can my child benefit from Redi Savings?

JN Bank Redi Savings is not available to children, but not to worry, JN Bank has accounts just for your children.

- To open an account for a child aged 11 and under, an adult must accompany the child and must also be on the account. An adult will also need to take along the child’s birth certificate.

- Children 12 to 17 years-old can open an account on their own using a valid student identification card that bears their signature and the signature of the school principal.