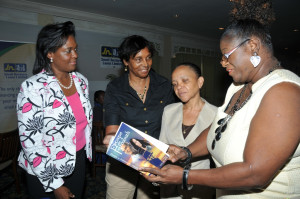

The novel “Escape to Falmouth” by publisher and author Lena Rose (second from left) of Minna Press on Mountain View Avenue, St. Andrew, has the interest of Thelma Yong (second from right), Credit and Risk Assessment Manager at JN Small Business Loans Limited and Andrea Graham (right), Chief Executive Officer of the Business Development Agency at the Women in Business Conference held at the Knutsford Court Hotel recently. Also in the photo is Sharon Smith, Consultant with responsibility for the JN Individual Retirement Scheme at the Jamaica National Building Society. Mrs. Yong says Jamaica can do more to support female entrepreneurism.

Thelma Yong, Credit and Risk Assessment Manager at the country’s foremost micro and small business finance company, JN Small Business Loans Limited (JNSBL), says Jamaica can do more to support female entrepreneurs in order to improve the country’s economic prospects.

Mrs. Yong, who has been involved in the business of financing micro entrepreneurs for more than two decades, says “there is a need for more education and training to help women grow their businesses.”

She affirmed that, “To encourage their continued development we must provide them with the right services, such as education and training, so that more women can become small, medium and corporate business owners, who will be able to contribute far more to our national competitiveness and employment,” and noted that women were at the core of the micro business sector, making up some 75 percent of those who received loans from JNSBL.

Pointing to the high unemployment rate of 16.3 percent, the highest level of unemployment the country has experienced in 15 years, Mrs. Yong said it was critical for women to get more support, given the country’s dependency on the small and micro business sector to drive the economy.

“Although national agencies such as the Jamaica Business Development Corporation and the Development Bank of Jamaica and private organisations, such as JNSBL, continue to facilitate access to financing and training, there is much more that we can do, as a country, to facilitate more opportunities for our women entrepreneurs to grow,” she opined.

She welcomed the new Security Interest in Personal Property Act, noting that it would allow more entrepreneurs to secure financing by using a range of assets of collateral. The Act was passed by parliament two weeks ago.

“These laws broaden the range of collateral, so that micro and small business owners can secure loans without having to draw on traditional capital—such as funds in a bank account, land and motor vehicle,” she said in support of the new legislation, which will allow persons to collateralise loans using assets such as equipment, appliances and even intellectual property.

“There are women with great ideas, some with interest in cultural industries, who have been having difficulty with accessing funds because they don’t have traditional capital for security,” Mrs. Yong added, pointing out that her company has traditionally accepted equipment used in the business and appliances as security for micro loans.

The microfinance professional said that empowering women entrepreneurs is good for the economy because women often share their prosperity with their communities and families.

“Women often share their achievements with their communities by providing employment and through philanthropy; but, they also share their successes especially with their families, particularly their children,” Mrs Yong affirmed.

She stated that throughout her career in microfinance, she experienced instances in which the children of especially poor rural women have developed because their parents, especially their mothers, were able to access microfinance.

“Women are also good for the microfinance industry because they usually share their experience and encourage both men and women to borrow in order achieve successes similar to their own,” Mrs. Yong stated. And, pointing to the performance of JNSBL’s portfolio, she said, “Women are good risks because they repay their loans on time and invest the money in expanding their businesses.”